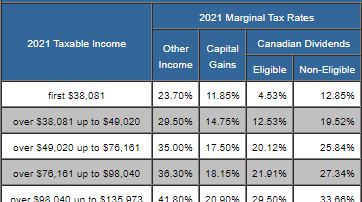

2021 marginal brackets

Youve filed your taxes put away your tax documents and possibly cashed your refund check. Income Tax rates tax bands tax brackets and tax thresholds for the 202122 and 202223 tax years.

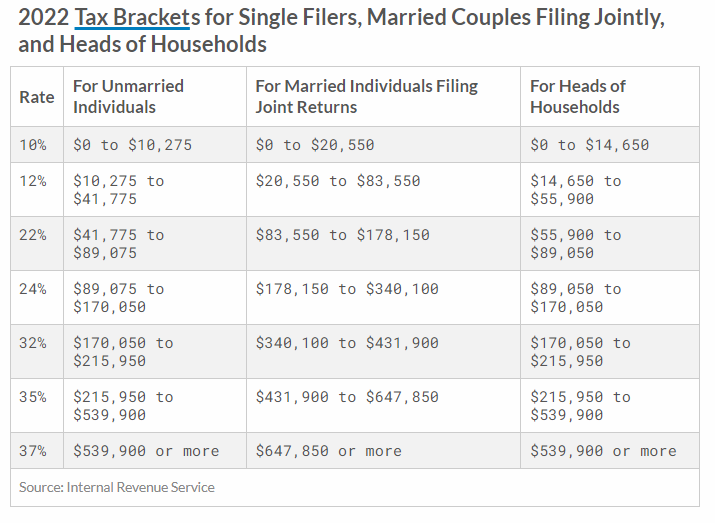

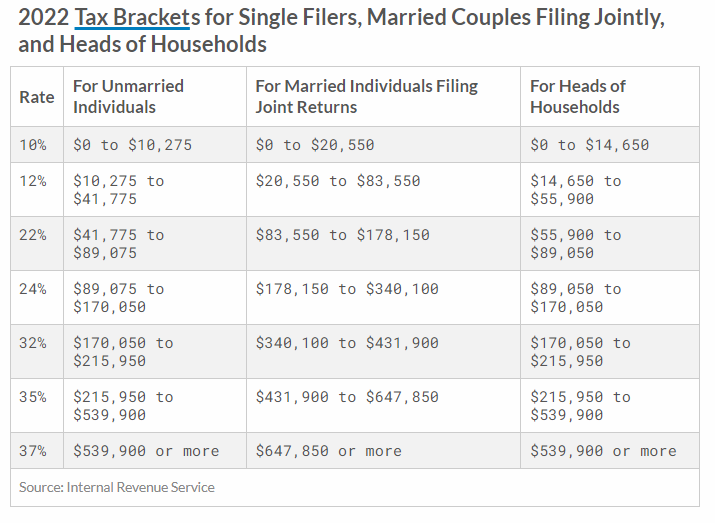

Tax Foundation On Twitter 2022 Tax Brackets Https T Co Ppudrxlsoq Https T Co Fqaga4odlw Twitter

Federal Individual Income Tax Rates Brackets 1862-2021.

. 10 12 22 24 32 35 and 37. Saskatchewans 2020 Budget reinstated indexation starting in 2021 using the federal indexation factor. States often adjust their tax brackets on a yearly basis so make sure to check back later for Federal updated tax year.

The personal exemption for tax year 2021 remains at 0 as it was for 2020. A marginal tax rate is the amount of tax paid on an additional dollar of income. There are 5 tax brackets.

10 12 22 24 32 35 and 37. Learn about tax brackets and how to calculate your average federal tax rate and marginal federal tax rate. English and Northern Irish basic tax rate.

At the other end of the spectrum Hawaii has 12 brackets. When your income rises above a tax threshold you start to pay tax on that income at the higher tax band sometimes referred to as a tax bracket. In Ontario tax brackets are based on net income for income tax purposes.

2021 Tax Brackets for Single Filers and Married Couples Filing Jointly. After his RRSP contribution and other tax deductions and tax credits he has taxable income of. The highest bracket your income falls into without exceeding it represents your marginal tax rate.

Example of tax calculation. The term marginal tax rate refers to the tax rate paid on your last dollar of taxable income. John has been contributing to a Wealthsimple RRSP to reduce his taxable income.

Kansas for example is one of several states imposing a three-bracket income tax system. Over 45142 up to 90287. If you are a single filer and have 40000 in taxable income in 2021 you paid 10 on the first 9950 12 on the next 30575.

240 per week 1042 per month 12500 per year. At the other end of the spectrum Hawaii has 12 brackets. Owolabis provincial marginal tax rate is apparent at 1116 as this is the highest tax rate he pays on an additional.

News Release IR-2021-216 IRS announces 401k limit increases to. Over 46227 up to 92454. The 2021 tax brackets indicate how much tax you should pay during the year in 2021.

New Hampshires biennial budget reduced the states Business Profits Tax BPT its corporate income tax from 77 to 76 percent. Remember however that these are marginal tax rates. For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523600 and higher for single filers and 628300 and higher for married couples filing jointly. 2021 Income Tax Brackets Taxes Now Due October 2022 With An Extension. Quebec 2022 and 2021 Personal Marginal Income Tax Rates.

Ad See Whats Been Adjusted for Income Tax Brackets in 2022 vs. 20 on annual earnings above the PAYE tax threshold and up. The political discussion around taxing high-earners usually revolves around the income tax but in order to get a complete picture of the tax burden high-income earners face it is important to consider effective marginal tax rates.

Top marginal rates range from North Dakotas 29 percent to Californias 133 percent. There are seven tax brackets for most ordinary income for the 2021 tax year. Thats because using marginal tax rates only a portion of your income is taxed at the 24.

The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. Your tax brackets will be slightly higher for example as will your standard deduction. 2020 to 2021.

That means that the highest rate applies only to money you earn above and beyond the upper limit of the lower rate. In some states a large number of brackets are clustered within a narrow income band. 2021 Federal income tax brackets 2021 Federal income tax rates.

An example of how marginal tax rates work. The 2021 tax season is over. Your tax bracket depends on your taxable income and your filing status.

If you are single and your taxable income is 75000 in 2022 your marginal tax bracket is 22. Nebraskas top marginal rate lowered from 781 to 75 percent as a result of Legislative Bill 432 with a further reduction to 725 percent scheduled for 2023. Discover Helpful Information and Resources on Taxes From AARP.

Saskatchewans 2021 Budget reduced the dividend tax credit for 2021 but then increases it for 2022 to 2024. The indexation factors tax brackets and tax rates have been confirmed to Canada Revenue Agency information. The marginal tax rate for an individual will increase as income rises.

Here are the Ontario income tax brackets for the 2021 and 2022 tax years. Marginal Tax Rate. When you file your tax return in 2022 youll indicate how much you paid and determine whether youre owed a refund or if you need to.

The Federal tax brackets on this page have been updated for tax year 2021 and are the latest brackets available. Now were in the 2022 tax year and there are some major differences from 2021. The marginal tax rate is the amount of additional tax paid for every additional dollar earned as income total tax paid divided by total income earned.

The maximum credit allowed for adoptions for tax year 2022 is the amount of qualified adoption expenses up to 14890 up from 14440 for 2021. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Top marginal tax rates are therefore the subject of much academic interest eg Saez 2001.

However some of your. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Meet a fictional chap named John who lives in British Columbia.

Claiming 97 Percent of Small Businesses Exempt from Biden Taxes Is Misleading. In addition to marginal tax brackets one of the major features of the Federal income tax is deductions. 45142 or less.

380 Idahos top marginal individual income tax rate and third-lowest rate were both eliminated. The effect of these marginal bands is that you will pay tax on any income at the relevant rate. Quebecs indexation factor is calculated using the Quebec consumer price index CPI All-items excluding alcoholic beverages tobacco products and smokers.

The 4 and 5 percent brackets remain in place. Top marginal rates range from North Dakotas 29 percent to Californias 133 percent. Learn about tax brackets and how to calculate your average federal tax rate and marginal federal tax rate.

Your marginal tax rate is the total of both federal and provincialterritorial taxes on income. The remaining rates were each reduced by 0125 percentage points except for. This method of taxation.

There are seven federal tax brackets for the 2021 tax year. The Quebec tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 10264 a 264 increase.

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Tax Foundation On Twitter 2022 Tax Brackets Https T Co Ppudrxlsoq Https T Co Fqaga4odlw Twitter

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Taxtips Ca Newfoundland And Labrador 2020 2021 Personal Income Tax Rates

Individual Income Tax Rates 2021 22 The New Daily

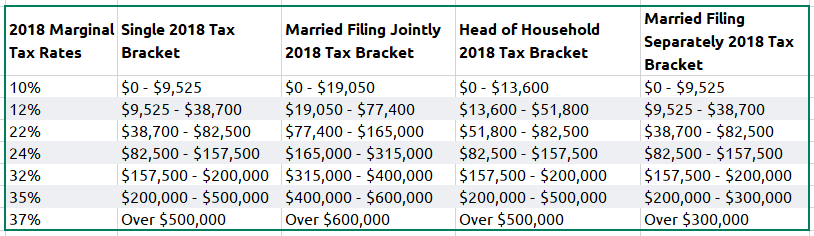

Tax Help For Your 2018 Filing

Tax Foundation On Twitter 2022 Tax Brackets Https T Co Ppudrxlsoq Https T Co Fqaga4odlw Twitter

2020 2021 Tax Brackets And Federal Income Tax Rates Explained Expensivity

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Understanding Marginal Income Tax Brackets

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

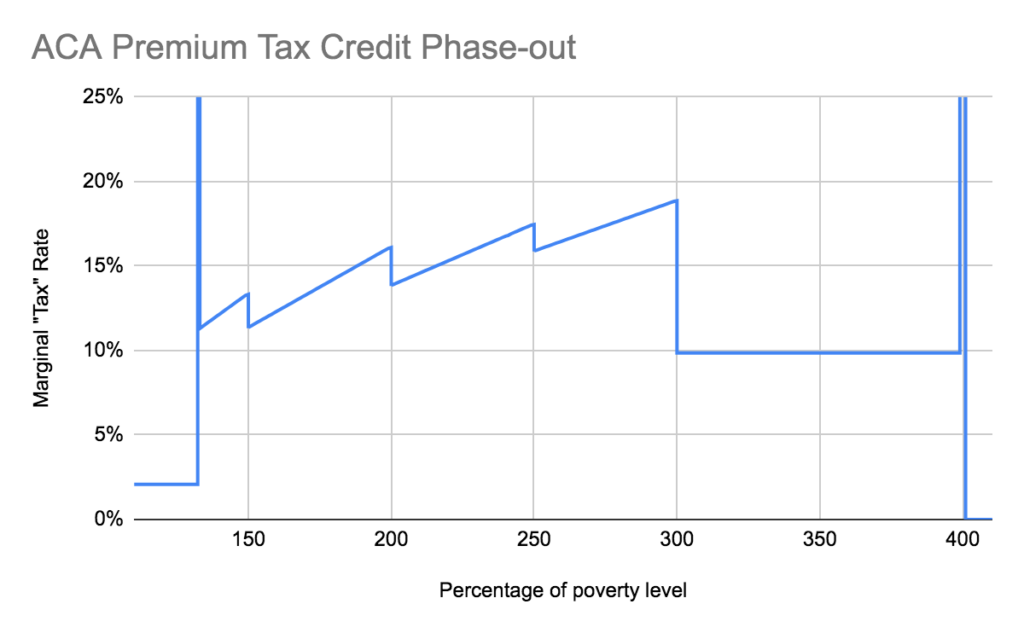

Marginal Tax Rates Under The Aca Seattlecyclone S Blog

How Much Tax Would I Pay On An Annual Salary Of 80 000 In Ontario Canada Quora

Marginal Tax Rates Under The Aca Seattlecyclone S Blog

Irs Tax Brackets Here S How Much You Ll Pay In 2021 On What You Earned In 2020